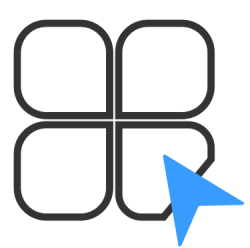

Research-Driven Investment Approach: Bank of China Investment Management's investment decision-making process is based on in-depth market research and company analysis to ensure the scientific and forward-looking nature of investment decisions.

Combining Macro and Micro Analysis: The company utilizes the MPELVIS system for macro analysis and integrates bottom-up stock analysis to identify investment opportunities with long-term growth potential.

Utilizing the MPELVIS system (Macro economy, Policy, Earnings growth, Liquidity, Valuation, Institutional factors, and Sentiment), the BOCIM conducts thorough macro and strategic analysis to guide sector and market allocation decisions. Simultaneously, through a detailed bottom-up approach, high-potential individual stocks are identified to maximize returns in varying market conditions.

In industry selection, BOCIM's investment team not only assesses individual company situations but also considers the broader industry landscape, encompassing trends, competition, regulatory impacts, and technological advancements. Qualitative and quantitative analytical techniques, along with competitive analysis, are employed to evaluate management quality, brand strength, and market positioning. Financial ratios, cash flow analysis, and earnings projections are utilized to delve into a company's financial statements, business models, and growth trajectories.

BOCIM's research and investment workflow emphasize collaboration with industry experts and the integration of internal and external resources to merge financial research with industrial research. This comprehensive methodology enables the investment team to gain better insights into industry dynamics, identify investment opportunities, and make timely adjustments in the rapidly changing market environment.

Equity Fund

Bond Fund

Mixed Assets Fund

Money Market Fund

Other Innovative Funds

SMAs

Alternative Investment

International Business

14 years working experience on average

13 years working experience on average

17 years working experience on average

8 years working experience on average

7 years working experience on average